Latest Posts

The OEM Chip business is highly expected due to the dropping price of NAND Flash

According to the comments from Samsung Electronics Co-CEO, due to global trade tensions, slowing economic growth and declining demand for memory chips from data center companies, Samsung Electronics known as the world’s largest memory chip company suffered a lot. In terms of this tough situation, Samsung Electronics would not reduce its investment in the semiconductor industry. On the contrary, Samsung Electronics may continue to invest more in the semiconductor business, one of which would be OEM Chip business. However, this action would exacerbate its rivalry with TSMC, the OEM Chip industry leader.

OEM Chip business was highly expected

According to info from DRAMeXchange, Samsung accounted for 35% of NAND flash market share and 43.9% of DRAM share in 2018, which were far ahead of other memory chip companies. Toshiba ranked second in NAND market with 19.2% market share, while SK Hynix followed Samsung in DRAM market with 19.2% market share. It can be seen that Samsung was dominant in the memory chip market.

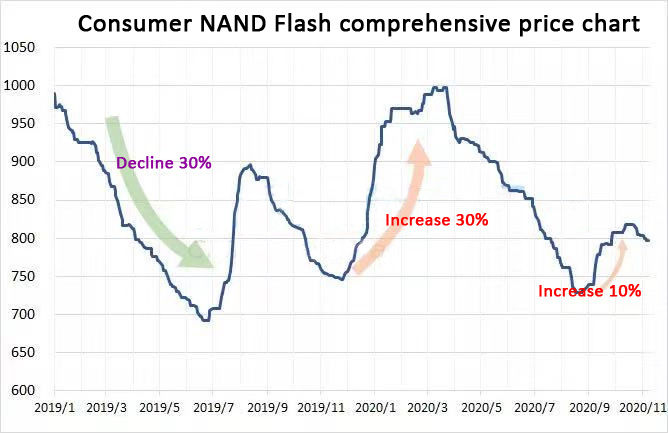

Samsung has benefited a lot in the past three years, thanks to the process of rising memory chip prices. What’s more, Samsung succeeded in surpassing Intel to become the world’s largest semiconductor company in 2017, after Intel dominated the semiconductor industry for 24 years. In 2018, Samsung further consolidated its lead over Intel in semiconductor business revenue. It’s a pity that with the prices of NAND Flash and DRAM chips fell into reduction cycle; the industry expected that Samsung might be no longer the leader of semiconductors this year.

IC insights estimated semiconductor business revenue in 2018 of Samsung and Intel were $83.258 billion and $70.154 billion respectively. The industry thought price reduction in memory chip would decrease by 20% in Samsung’s semiconductor business revenue. As Intel’s revenue increased by 13% in 2018, it’s expected its semiconductor business revenue would continue to grow in 2019. The current revenue gap between Intel and Samsung is 18.7%. So it is quite possible that Intel will exceed Samsung this year.

Faced with such price reduction, Samsung continued its previous counter-cyclical operation and increased investment in memory chip business. Why Samsung did that is relied on counter-cyclical investment to win in memory chips, LCD panels and OLED panels. Therefore, when memory chips entered a depressive period, Samsung should continue this strategy in order to make a big profit in the next upward cycle.

In addition to invest more in memory chips, Samsung was considering OEM chip business as a new opportunity in the semiconductor industry. The global OEM chip market is worth nearly $60 billion. Samsung desired to gain a quarter of market share in the global chip OEM market, with the aim of earning $15 billion. Coupled with the revenue from memory chip business, Samsung could hit hundreds of billion in revenue, which would help it further consolidate its dominant position in the semiconductor industry.

Samsung started a fierce battle with TSMC in chip foundry market.

In the global chip foundry market, Global Foundries and UMC would no longer develop 7nm or the advanced technology of this size. SMIC as the fifth largest chip foundry factory was still weak in research and development. In short, the chip foundry market has become a contest between Samsung and TSMC.

Samsung has taken the lead in 14/16 nm FinFET and 10 nm technology, but TSMC gave priority to the production of 7 nm technology. It was expected that TSMC will probably take the lead in more advanced EUV technology. In addition, TSMC started to develop 5nm or 3nm technology. Even though the good situation has gradually preferred to TSMC, its dual-head system was becoming an obstacle to its development.

Zhang Zhongmou, founder and chairman of TSMC, was determined to retire in June 2018. General manager and co-CEO, Liu Deyin, took over as the chairman with top decision-making authority. Another general manager and co-CEO, Wei Zhejia, took over as the president and had to report to the chairman and the board of directors. Such two-person co-leadership model is known as “dual-head system”. The arrangement was highly praised at that time. However, successive computer virus infections and wafer defects appeared to show that it’s dual-head system that caused internal management problems. This may provide an opportunity for Samsung to catch up with TSMC.

The poor global economic environment is forcing many enterprises to control costs, especially for chip design enterprises. TSMC has always been unwilling to easily reduce the price of chip OEM, even faced with powerful companies such as Apple, which has made TSMC gain a very high net profit margin. TSMC’s net profit margin was as high as 34.5% in the fourth quarter of 2018, higher than Apple.

Samsung, by contrast, was more active in price policy. In order to obtain Apple A9 processors orders, Samsung offered much lower contract price than TSMC in 2015. There was little difference in chip manufacturing technology between Samsung and TSMC. At present, taking into account costs, AMD has handed over some orders to Samsung. Similarly, NVIDIA also intended to do so. Due to the frequent problems and the high price of chip OEM, it’s likely that more customers would hand over part of their orders to Samsung to spread the risk.

Samsung’s capital expenditure in 2017 was as high as $44 billion, the highest one in the world. Although its capital expenditure in 2018 has been reduced, it still ranks first. One of its investment businesses was chip manufacturing. It’s huge investment that made Samsung a strong competitor for TSMC. If TSMC continued to go wrong, it was likely that Samsung would achieve its goal to account for a quarter of chip foundry market. In fact, Samsung’s share of the chip foundry market has been double in 2018. IC insights estimated that Samsung won 14% of the global chip foundry market in 2018, while only 6% in 2017.

Leave a comment