after the resumption of work: Multiple factors have caused consumer SSD prices to rise significantly!

Recently, mainland enterprises have actively resumed work. However, due to the lack of original supplies and the “epidemic” which has hindered the production and supply of packages, the prices of some Flash particles, SSDs, flash memory cards and other products in the market have continued to rise. The price increase of the product in the SSD market is relatively obvious. Compared with the quotation before the Chinese New Year holiday, the highest increase in SSD price is more than 15%, and the prices of embedded eMMC and eMCP remain unchanged.

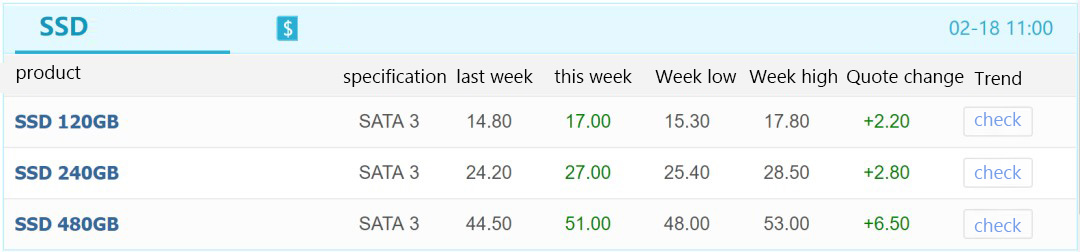

According to the quotation in China’s flash memory market, the overall price in SSD market rose sharply this week (February 18). The channel market price of SSD SATA 120GB has increased from US$14.8 to US$17, the 240GB price has increased from US$24.2 to US$27, and the price of 480GB has increased from US$44.5 to US$ 51.

Latest offer of channel SSD (February 18)

Industry market OEM PCIe SSD 128GB price increased from US$21 to US$22, 256GB price increased from US$31.5 to US$35, 512GB price increased to US$52 to US$59; SATA SSD 128GB price increased from US$17.5 to US$19.5, and 256GB price increased from US$28.5 to US$33, the price of 512GB increased from US$50 to US$57.

Latest offer of industry SSD (February 18)

Previously, the Chinese flash memory market analyzed the impact of the “epidemic” on the storage industry in the articles “Analysis of the impact of the ‘epidemic’ on the storage industry” and “The storage market under ‘epidemic’, chain reaction made it difficult for enterprises to supply” Now the impact of the “epidemic” is still there. In the first week after the resumption of work, SSD prices have shown a rising trend. What is the reason behind this? What is the current market situation and how will it affect companies?

Under the impact of the “epidemic”, as well as the fact that the original factories have fewer supplies and do not change its attitude toward price increases, these set the tone for price increases.

In 2019, Samsung, Kioxia, Western Digital, Micron, and SK Hynix face challenges in profit making. Even though the NAND Flash prices rose in the second half of the year, the original factory’s financial situation was still not improving. In 2019, not only did Samsung’s annual net profit fell by 51%, but Micron’s net profit also fell by 76%. In the fourth quarter, SK Hynix has fell into a loss for the first time in 7 years. Kioxia and Western Digital fell into losses, with net losses of 195.8 billion Japanese yen (about $ 1.8 billion) and USD$1.193 billion, respectively.

After the cold winter of 2019, the original factory is optimistic about the strong demand for the storage industry in 2020, especially the strong demands in 5G, data centers, etc., which is expected to drive up the price of NAND Flash and improve financial conditions. In recent financial reports, Samsung expects decrease in DRAM demand in the first quarter of 2020, NAND Flash price will increase as server demand grows. Micron predicts that DRAM and NAND Flash supply will be lower than expected in 2020, while enterprise SSD will be in short supply, this will drive prices up. Despite severe losses, KIOXIA’s quarterly shipments of NAND Bits have increased. It is expected that ASP’s upward trend will continue, and promote the balance between supply and demand in 2020.

Obviously, the original factory is very optimistic about the demand in data centers, enterprises and other fields, and is bullish on the NAND Flash market. Therefore, the original factory continues the strategy of focusing on high-profit markets and strictly controlling the supply just like before the Chinese New Year holiday. The strategy of the original factory has become the other reason for NAND price rise. Although currently affected by the “epidemic”, the upstream original NAND Flash production bases are mainly overseas, and the factories in the mainland and the domestic Yangtze Memory are also relatively less affected because of the high protection level of the FAB factory itself. So, the NAND Flash capacity output has no problem, but the original factory supply is still very small, especially the channel market is basically out of stock, coupled with the impact of logistics and transportation on production and supply, which in turn stimulates further price increases.

Common problems in the storage industry: prices continue to rise, transactions are deadlocked

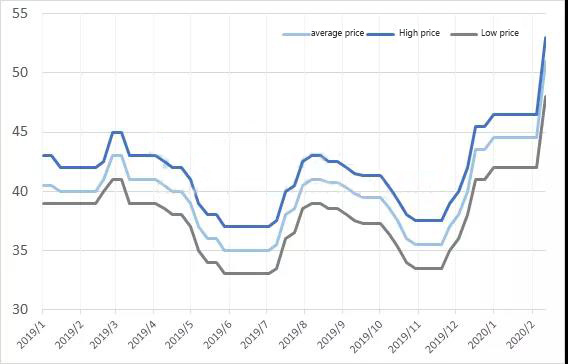

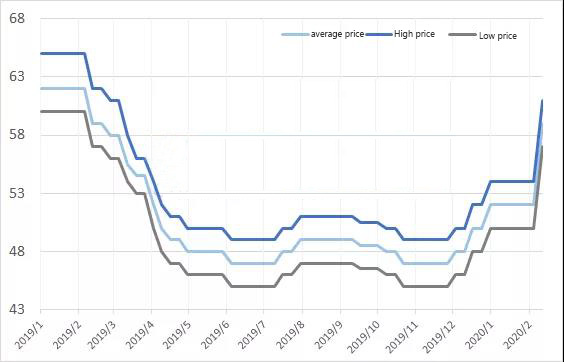

In the second half of 2019, SSD has experienced two price increases. At the end of the year, the prices of some SSD products have risen to the highest point. After the Chinese New Year holiday, the prices have increased significantly again. According to the quotation of China Flash Market, from the end of November 2019, the channel price of SSD SATA 480GB has risen from US$35.5 to US$51, a cumulative increase of 44%, and the industry SSD PCIe 512GB price has increased from US$47 to US$59, a cumulative increase of up to 25%.

Channel SSD SATA 480GB Price Chart

Industry SSD PCIe 512GB Price Chart

The current market situation is that the demand in domestic data centers, enterprises, and other areas continues to grow, but due to the continued increase in flash memory prices leading to increased costs, coupled with the lack of original factory supplies, and low resumption rates of enterprises, logistics, transportation and other factors, The short-term delivery is difficult, and overseas companies that have mainland customers also encounter delivery difficulties. However, since the inventory of downstream manufacturers was always insufficient before the Spring Festival holiday in the mainland, some companies had to purchase at high prices to replenish their inventory. It was also because of the increase in purchase costs and the suppression of orders in the channel market that lead to a general phenomenon of reluctance to sell.

Compared with the mainland market, corporate sales and factory production in Taiwan and overseas markets are less affected by the “epidemic”, coupled with demand from data centers and 5G mobile phones, market demand has performed well, but it also faces difficulties like higher price, increasing procurement costs and delivery to mainland enterprises. Merchants are unwilling to sell at a loss, which led to high prices for flash memory products, and the transaction has stalled, which has led to the decline in shipments in the first quarter.

In 2018 and the first half of 2019, the price of NAND Flash continued to decline and fell more than expected, making most storage companies miserable. Although the original factory actively improved the market supply and demand, the storage industry has not yet fully entered the growth channel. Due to the impact of the “epidemic” in the first quarter of 2020, the storage industry suffered a “cold spring” and coupled with the sharp rise in SSD prices, all made domestic enterprises suffer. However, most expert in the industry are optimistic about the storage market this year, which is expected to offset the downturn in demand.

Leave a comment