Latest Posts

The total shipments of SSD + eMMC storage modules have grown by 76% annually, Phison has published its 2019 financial report!

Phison has announced its financial report for December 2019, with consolidated revenue of NT$4,095 million. Compared with the same period in 2018, its revenue has increased by more than 38%. The total shipments of SSD and eMMC end products has increased by 93%, IPC storage module revenue increased by 49%, cumulative storage module shipments grew by more than 32%, and cumulative total storage bits (Total Bits) achieved a high growth of more than 98%.

|

subject |

YoY Growth ratio |

|

Total shipment of SSD and eMMC end product in December |

93% |

|

The operating income of IPC high-end storage module in December |

49% |

|

Annual total storage amount (total bits) |

98% |

|

Annual total storage module shipments |

32% |

In 2019, the NAND Flash market is full of difficulties, but Phison’s financial report shows many good results.

The storage industry in 2019 is not all smooth. Not only is it affected by the slow global economic growth, it has also experienced a sharp decline in both NAND Flash and DRAM prices in the first half of the year, and it has also been affected by uncertain factors in the trade war between China and the United States, Japan and South Korea. Its upstream manufacturers such as Samsung, Micron, and SK Hynix has experienced sharp decline in profit. Among them, Samsung’s operating profit in 2019 reached a new low since 2015, while Western Digital and Kioxia faced financial loss.

Downstream storage vendors also encountered the same challenges, but Phison’s financial performance was dazzling. In the fourth quarter of 2019, its revenue reached NT$13.173 billion, an increase of more than 30% compared with the same period in 2018. The total revenue of 2019 reached NT$46.693 billion, a 10% increase over the same period in 2018, and the quarterly and annual revenues reached record highs. Total shipments of SSD + eMMC storage modules have grown by 76% annually.

Winning Secrets? Facing the volatile storage market, Phison: Flexible supply and demand

Phison said that due to the flexible supply and demand in the whole year of 2019 and the overall booming demand recovery trend in the fourth quarter was in line with expectations. Phison continued to use the flexible and sound business model and various product application portfolio around the world and achieved historical success.

The NAND Flash market in 2019 can be described as turbulent. After the NAND Flash price experienced a sharp decline in the first half of the year, it experienced two price increases in the second half of the year. According to the quoted price China Flash Market, in the first half of 2019, the price of NAND Flash continued with the decline in 2018 and the decline continued to the end of June. The comprehensive price index of consumer NAND Flash fell by more than 30%, not only did the price returned to the level before the price increase in 2016, It has reached another record low price.

Consumer NAND Flash Price Index Trend

Source: elinfor.com, data as of January 9, 2020

By the second half year of 2019, due to the original factored production reduction, Japan-Korea trade war, and the power failure at the Kioxia factory, NAND Flash prices bottomed out and rose by as much as 30% in less than two months. Though the price has fallen a little, the strong demand for SSDs in data center, enterprises and other fields, coupled with the launching of 5G new machine has lead NAND Flash prices rise again from the end of November, and the rise has continued until the beginning of 2020.

2019 is a challenging year for most storage companies, and an opportunity for some companies. When facing volatile market conditions, they can use market fluctuations and price changes to obtain maximum profits. Obviously, Phison’s judgment on the NAND Flash market has performed well. From its annual financial report, it can be seen that revenue went up month by month from the second half of 2019, and in October it hit a high of NT$4.381 billion. It also hit a record high in the season.

Operation: The combination of Phison NAND control IC and NAND storage solution

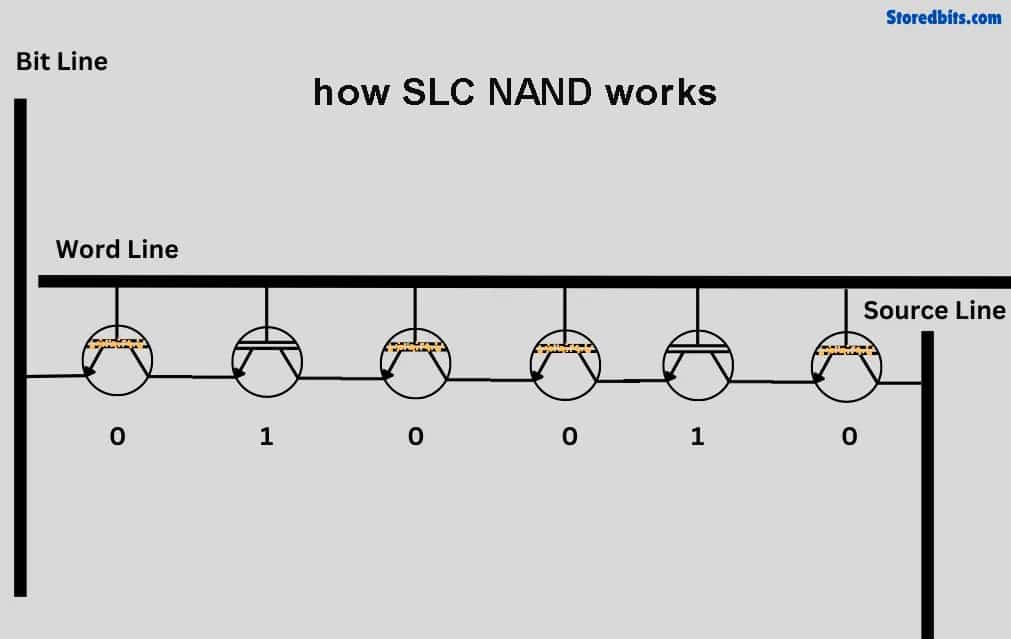

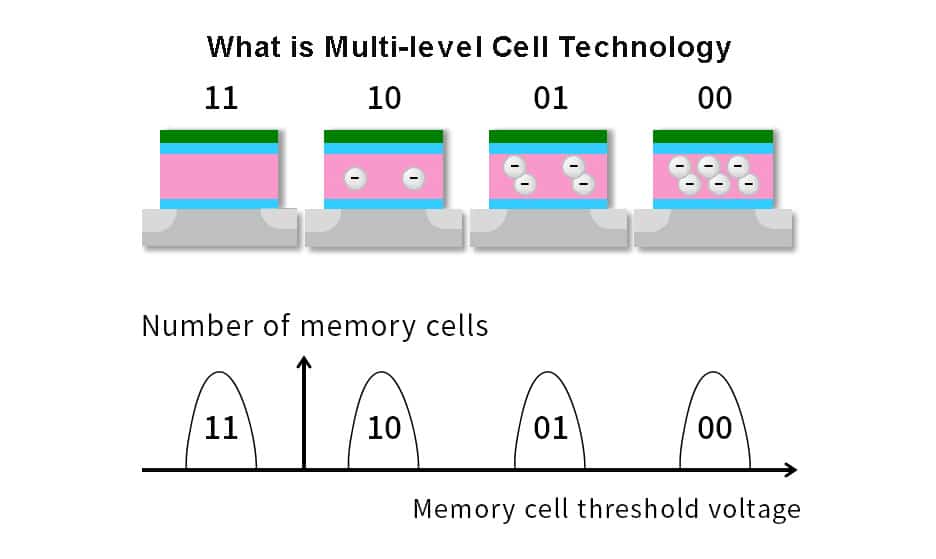

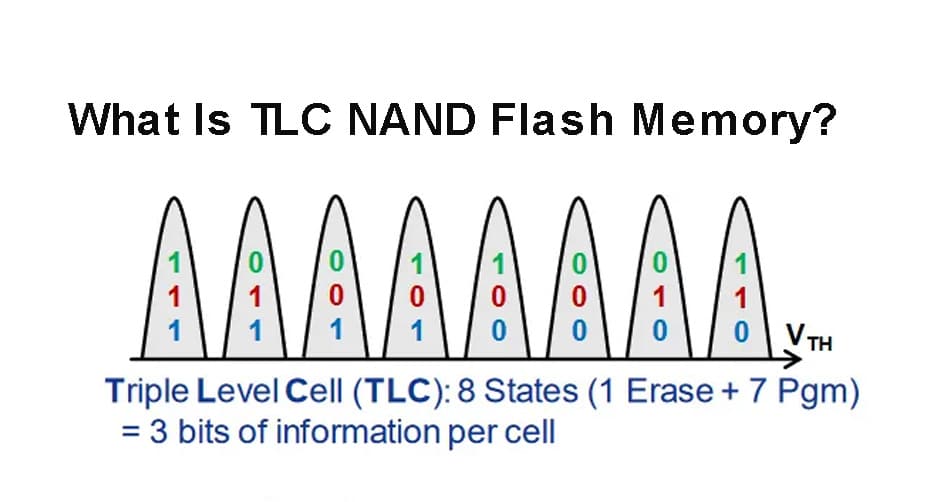

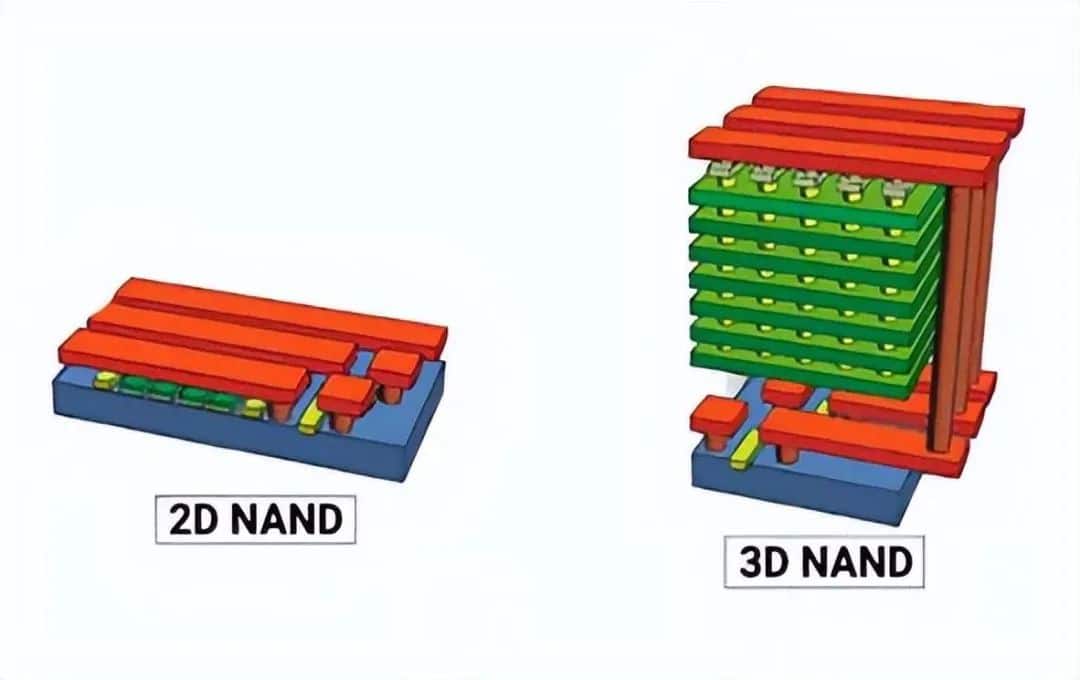

Phison is not only a NAND Flash master control company, that has research and development capabilities, but also a NAND Flash storage solution provider. In terms of control chips, Phison ‘s full series of SSDs support the latest QLC NAND technology, including PCIe 3×4 PS5012-E12, SATA PS3112-S12/PS3113-S13T, and the first PCIe Gen4x4 SSD control chip PS5016-E16.

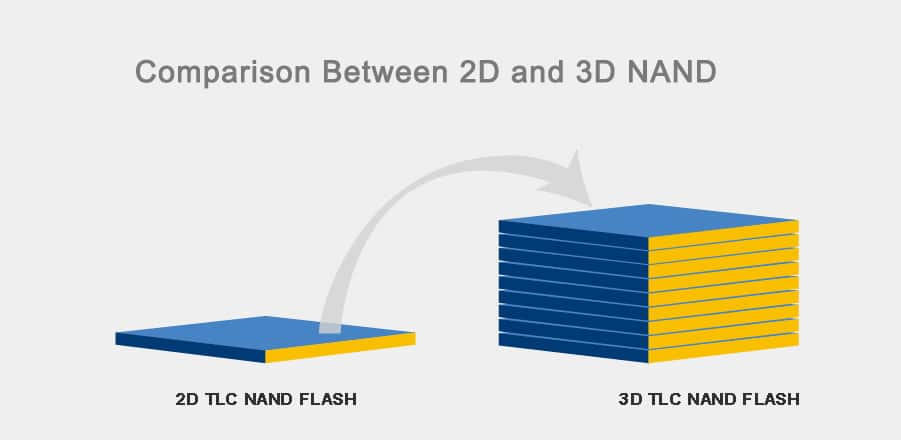

The development of QLC is a major trend, just like TLC has replaced MLC as the mainstream. In response to market development, Phison expanded QLC NAND support to give QLC SSD full play of advantages of in the market, accelerating the increase in penetration, and bringing better performance and stability to consumers.

On the other hand, with the continuous development of 5G technology, such as automotive electronics, artificial intelligence, audio and video streaming, high-definition imaging, smart homes, and IoT, their demand for storage is increasing. In addition to the increasing shipment in main control chip, SSD and eMMC, Phison performs well in the high-end IPC market, ensuring the high value and high profit of its products, further expanding its business and increasing its growth potential.

In 2020, the storage industry will be foreseeably good. It is also a good time for storage vendors to fight back. For old storage enterprises, they not only need to survive the hardships, but must also step forward and win with pride. In the future, the challenge will be how to grasp more NAND Flash resources and create more value and wealth.

Leave a comment