Latest Posts

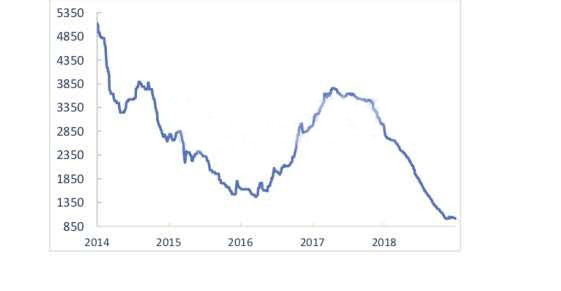

Current price dropping back to the old one prior to the increasing

The sales of Apple mobile phone in 2018 made the capital market shocked and Samsung mobile phone was not as popular as the past in the global market. Similarly, domestic mobile phone is always much cry and little wool. Such sales decline in mobile phone directly led to NAND Flash market saturated in 2018. Because supply exceeded demand, NAND Flash prices continued to fall up to 65% and SSD prices reduced up to 56%. The hot demand for Memory storage does no longer exist.

When the price of DRAM has been falling all the time, its price fell more than 30% in the Q1 of 2019. Take 8GB memory bar as an example. It rose continuously from more than $29.7 initially, to $44.55, $74.25, and $103.95. During its peak period, 8GB memory bar even reached at $148.5. Now it is dropping back to $29.7.

Price trend of Memory Bar

Although the price is close to the bottom point, it doesn’t seem to stimulate people’s desire to buy. Why does this phenomenon occur?

Current price dropping back to the old one prior to the increasingBuying when price rises and not buying when price drops.

It seems impossible to have such phenomenon, as the sales don’t rise significantly based on such big dropping. But this strange situation does appear, in fact, this phenomenon is not difficult to explain. People always buy things when price rises and don’t buy them when price drops. Even though the price is cheap enough, they are afraid that price will drop after they buy them. On the contrary, although people are indignant about increasing price, they are still willing to buy them and afraid of losing money if price increases. Therefore, this is not surprised. Who is controlling the price trend?

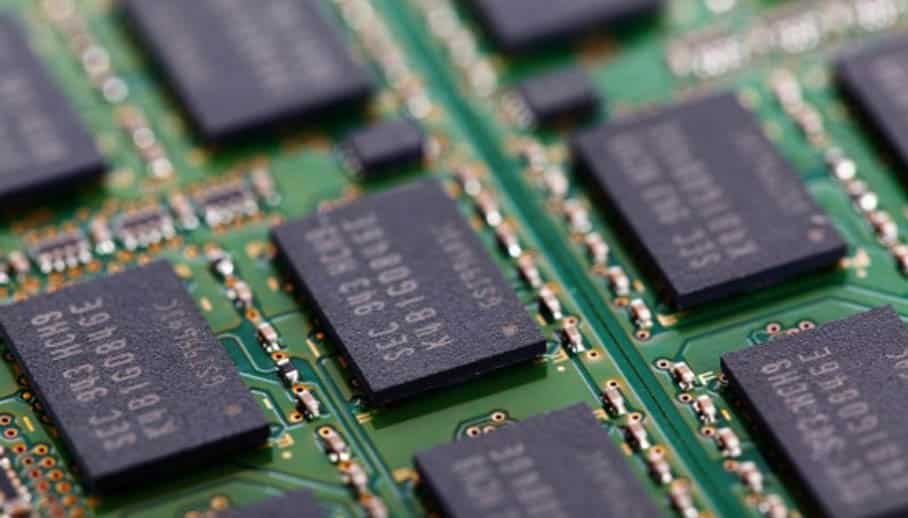

In storage industry, only a few ones really have the right to control price trend. As of Q3 of 2018, the three giants of memory particles, namely Samsung, SK Hynix and Micron, occupied a global market share of 95.7%, so other companies can be ignored.

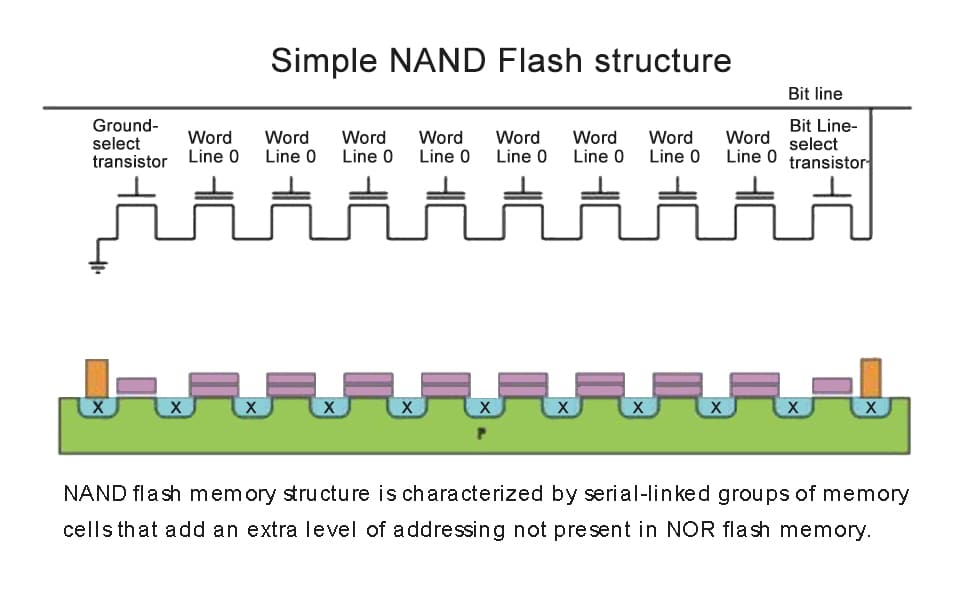

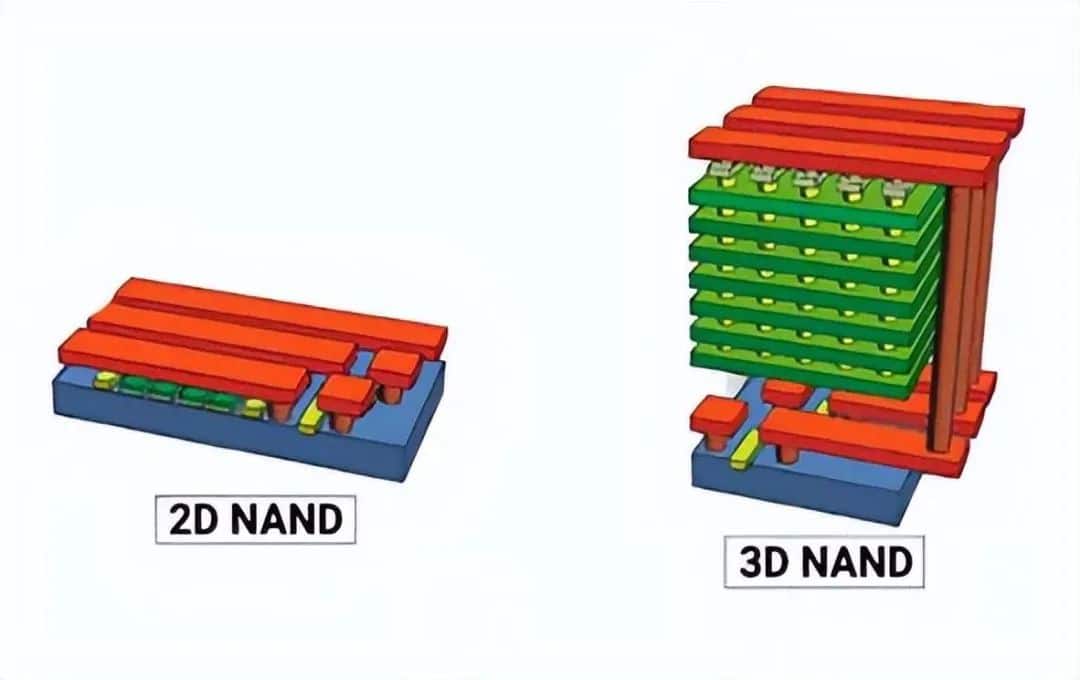

In fact, price trend is not complex to understand. A balance between supply and demand is always an important factor for affecting prices. The production capacity and the yield rate of the three giants have greatly increased in 2017 to 2018. In addition, Samsung, Western Digital and Micron have begun to produce 96-layer NAND in succession, it is resulted in the production capacity of single die will double. Thus, price is bound to fall because of oversupply.

Samsung LPDDR4X

According to financial reports issued by various companies, net profit for Western Digital in the third quarter of 2018 had dropped by about 32%. Meanwhile, Samsung’s profit in the fourth quarter of 2018 also fell by 38% and fell to $7.24 billion, it is far lower than $10.49 of the same period last year.

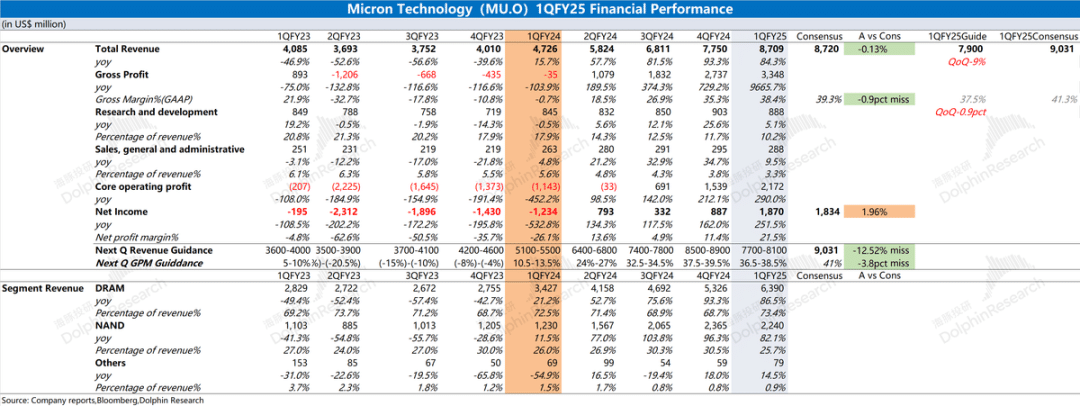

Micron, SK Hynix, Samsung and the other original factories have earned a lot of money in the past few years, with accurate market forecasting and excellent operation. In the face of current price reduction, they have already taken countermeasures.

In order to improve market demand and maximize corporate profits, the three giants have cut their investment budget in 2019, postponed 96-layer technology expansion plan and reduced the growth rate of NAND Flash. For example, Samsung has reduced the growth rate of NAND Flash to 30% in 2019, and production capacity of its plant in Pyeongtek is compressed repeatedly. Micron has also reduced its investment budget from $10.5 billion to $9 billion in 2019.

Price reduction is one favorite thing for everyone. In the first half of 2019, there will be little change in price. However, the original inventory of major giants has been largely consumed, and meanwhile, production capacity has been greatly reduced since last year. Therefore, the industry expects that the phenomenon of continued price decline will not be too obvious from the end of the second quarter, and there will be a bit increasing in price. Micron and Phison have been optimistic about the market demand in the second half of 2019. How about Intel?

When it comes to the relationship between supply and demand, Intel must be mentioned. Intel’s absolute advantage in processors has affected the shipment of computer parts industry. The fact that Intel’s new 10nm cannot be put into production in time which causes the demand for personal computers to be reduced. Such an awkward situation further leads to a decline in memory shipment.

This creates a situation where memory and SSDs are getting cheaper but don’t feel like hot sellers. The two are constantly interacting with each other, so it’s a dead end in a vicious circle. It also explains one of the fundamental reasons of “Buying when price rises and not buying when price drops” from one side. In summary, price is still affected by the relationship between supply and demand. The dropping price leads to the troubles?

So what do you think about the three giants suppliers? Will they be able to solve the problem of low price and no market in addition to shrinking production capacity? Talk about some gossips about fire and flood

Let’s go back to 2011.

In July, as the rainy season came, floods in Thailand flooded hard disk factories of Western Digital, resulting in a sharp drop in production capacity and depressive computer industry. Although natural disasters are terrible, they are still slightly inferior to human beings.

On November 22, Seagate’s CEO said that it would take until the end of 2012 to restore the pre-disaster capacity supply of hard disk, and that consumers would go through at least 20% price increases in the first quarter of 2012. It’s not rain but money in Thailand flood area.

On November 23, Western Digital’s CEO said that floods flooded hard disk factories in Thailand and caused parts supply chains to break down. As production capacity of Western Digital and Friends declined sharply, hard disk prices were forced to rise.

By the end of November, the price of hard drives had risen by about 20%, affecting about 40% of global production capacity. Seagate CEO said that some customers had come to Seagate on their own initiative, eager to book some of Seagate’s production capacity, in spite of price increases. Some customers had already $250 million in advances. Although there was no malicious manipulation, Seagate’s share price indeed exceeded $17, rising by 67% compared with the pre-disaster.

Seagate’s CEO said he could have raised the price of hard drives by 40%, but he did not do so. Instead, he raised the price by 20% to those who promised to sign an order contract for one to three years.

In fact, besides from Western Digital, Seagate and other manufacturers were not serious about capacity damage during Thailand’s floods, because factory capacity in Thailand accounted for a very small proportion. In addition, some hard disk manufacturers like Fujitsu had no factories in Thailand. The rising price was indeed “Sima Zhao’s ill intent is known to all-the villain’s design is obvious”.

Let’s go back to 2013.

On May 9, 2013, a fire broke out in Tripod Technology, Wuxi, Jiangsu Province. Tripod Technology mainly engaged in printed circuit boards, supplying hard disks and memory strips. Its supply of memory strips was the first in the world. Therefore, the great impact on the whole industry was conceivable.

A fire broke out in SK Hynix’s factory in 2013 (Image from Sina Weibo)

At this point, Taiwan began to raise prices, when memory strips no longer went out of storage. In Shenzhen, Kingston’s 4GB DDR31600 memory price reached more than $36.38, while Beijing memory agents declared no goods.

On the afternoon of September 4, 2013, a fire broke out in SK Hynix Semiconductor, Wuxi, what’s worse, affected the surrounding factories. The fire led to a sharp decline in the capacity of SK Hynix’s factory in Wuxi, directly reducing the supply of memory chips and further resulting in volatile memory prices. This fire was the biggest event in the memory industry in 2013. Conclusion

According to current market, if you want to purchase memory products and SSDs, do not wait and see. Just do it before price increases.

Reasonable price increases are certainly acceptable for consumers, but some bad manufacturers and distributors turn natural disasters into man-made disasters, which is tantamount to killing the goose that laid their golden egg.

By the way, do you hear that TSMC has scrapped nearly 100,000 wafers?

Leave a comment