Latest Posts

Short-term NAND prices are now under downward pressure, when will the market condition get better? Phison: Supply will be tight in the second half of next year

Due to the peak season stocking and Huawei’s “hoarding” effect, storage product prices rose sharply in September and October. However, the server market continued to be weak in the fourth quarter, and the notebook market has a decline in shipments due to the lack of semiconductor components. Also, the overseas “epidemic” hit again, the retail market demand is in a downtrun, and the storage industry gets in trouble once again.

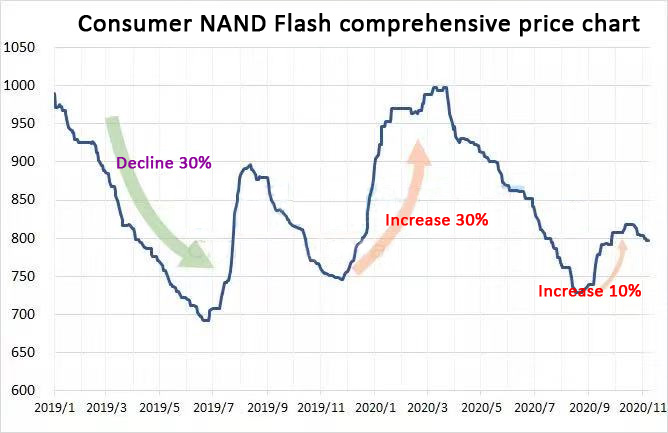

It is reported that the storage market has start to grow significantly since late October, and some product even dropped its price slightly in November. According to the quotation of elinfor.com, the consumer NAND Flash composite price index has fallen by 4% in the past half month. At present, the mainstream industry market SSD and memory bar prices are maintaining a stable trend, but the risk of subsequent decline is not ruled out .

Source: elinfor.com, data till November 18

Demand is declining while inventories are rising. The manufacturers predict that NAND flash prices will fall in the short term

After the cold winter in the the storage industry in 2019 and the impact of the “epidemic” in 2020, the inventory levels of Micron, Western Digital, Samsung, and SK Hynix continued to rise. By the third quarter, Western Digital, Samsung, and SK Hynix all reached 3-year-high inventory level. Micron has also far exceeded the normal inventory level of 110 days.

When predicting market conditions in the fourth quarter, the manufacturers all believe that short-term demand and prices will face downward pressure

Samsung: In the server market, demand may continue to be weak and SSD prices will fall because customers continue to adjust inventories and conservatively manage their capital expenditures. Also, there is increased competition in the mobile phones and consumer electronics field, profits are expected to decline in the fourth quarter.

Western Digital: The epidemic has slowed down the server installation speed of in data centers. Cloud customers are still in the “inventory digestion period”, demand from data centers will decrease, and prices in the OEM market will drop from October to December. The income of client SSD also declined continuously because of the decline in price.

Kioxia: The current market is in an oversupply status. The short-term demand in the terminal market is severely affected by the epidemic and trade frictions. In the short term, the price of NAND Flash will decline accordingly. Although the shipment of NAND Flash bit will be limited by overall demand, the game market has strong demand for high-capacity SSDs, which will offset the decline in demand in a certain degree. In the long run, Kioxia remains positive in the overall upward trend of the storage industry.

Micron: Due to “epidemic” globally, expenditures in the IT industry have decreased, leading to an increase in some customers’ inventories, and the demand for storage in the enterprise market has weakened.

Intel: Weak market demand in the data center field has also dragged down the performance of the storage sector. Business revenue from data center in the fourth quarter will decline by 25% compared with the previous year.

When will the market condition improve? Phison: Supply in NAND Flash market will become tight from the third quarter of next year

Pan Jiancheng, Chairman of Phison, stated that the mobile phone, PC and server markets will have strong momentum in 2021, and the operational outlook is optimistic. As for the NAND Flash market, it is expected that the supply will be tight in the second half of 2021.

Pan Jiancheng said that the company’s mobile phone-related mobile business will increase. In 2021, eMMC modules and other businesses will start from zero, and their revenue contribution will increase significantly. At the same time, demand from PC and server market will increase significantly. Phison has already won the entry tickets for the PCIe Gen 4.0 SSD card slot from several top manufacturer, coupled with the layout plan on the car storage module solution. We can predict very optimistically that the overall market demand will grow substantially in 2021. The operational outlook is optimistic, and it should be good for the next 3-5 years.

The optimism about the market situation in 2021 is mainly reflected in the following aspects:

After the outbreak of the “epidemic” in 2020, investment confidence in the capital market will gradually recover, and driven by 5G, data centers are expected to restart procurement demand in 2021 after inventory adjustments.

The demand of PC market continues its steady growth. Lenovo estimates that the PC market sales will be between 290 million and 295 million units in 2020, and may increase by 5% in 2021 to exceed 300 million units.

In the mobile phone market, the growth of the global mobile phone market will be driven dominated by the sales of 5G mobile phones. Qualcomm predicts that by 2020 there will be more than 200 million 5G smartphones worldwide, and this number will reach 450 to 550 million in 2021, doubling the growth.

Therefore, regarding the NAND Flash market conditions, Pan Jiancheng believes that the first quarter of 2021 is the traditional off-season, but demand will gradually improve. It is expected that the NAND Flash market supply will become tight in the third quarter, and will remain tight in the second half of the year. He is optimistic about the continuous growth in NAND Flash market demand in the next 5 years.

Leave a comment